Aged Care Fund IV SFDR disclosure

Summary

The Northern Horizon Aged Care IV Nordics Sub-Fund (“ACIV” or the “Fund”) is a closed-ended real estate fund. The Fund was incorporated in Luxembourg in December 2019, and it should be considered as a long-term investment.

The Fund’s core strategy is to invest in care properties in the four Nordic countries of Denmark, Sweden, Finland, and Norway. These markets benefit of strong economies, stable political environment, and pan-Nordic concept of universal healthcare. Management is executing the investment strategy by acquiring, primarily through acquisition of turn-key development projects, purpose-built care properties leased on long lease contracts to private or public sector residential care providers. The Fund’s primary investment focus is on aged care properties, but, to a limited degree, the Fund can also secure appealing investment opportunities in related sectors, such as (but not limited to) properties in senior housing, clinics, hospitals, or rehabilitation centres. All acquisition targets must naturally comply with the investment criteria of the Fund.

Fund promotes environmental or social characteristics within the meaning of Article 8 of the Sustainable Finance Disclosure Regulaition (2019/2088) (“SFDR”). The Fund does not have sustainable investment as its objective within the meaning of Article 9 of the SFDR.

The Fund aims for a carbon-neutral portfolio from operations by 2030, provided that the investment environment allows it. In real estate operations, carbon dioxide emissions derive mainly from energy use, i.e. electricity and heating. Therefore, the Fund commits to strive for 100% fossil-free electricity by 2025 across all real estate assets in the portfolio. The Fund makes also a commitment to non-fossil heating by 2030 across the portfolio.

The Fund measures the attainment of the characteristics by sustainability indicators such as the percentage of the assets in the portfolio that used fossil-free electricity, percentage of the assets in the portfolio that use fossil-free heating, operational electricity from renewable sources, operational GHG emissions.

The Fund follows Northern Horizon Capital Group’s Responsible Investment Policy that has factored in the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights, as well as Northern Horizon Capital’s risk management policies and processes.

For conducting ESG due diligence, monitoring the attainment of the characteristics and engaging with stakeholders, the Fund complies with Northern Horizon Capital Group’s Responsible Investment policy and Investment policy. The sustainability indicators are investigated in the due diligence phase for new investments and measured and reported at least annually. Northern Horizon Capital Group has established an ESG Task force that is led by Head of Sustainability and includes Portfolio, Fund and Asset Managers. In accordance with Northern Horizon Capital Group’s Responsible Investment policy, the Task Force gathers at least quarterly to discuss the relevant developments of the ESG factors for the Fund and it may recommend actions to achieve the Fund’s targets. Northern Horizon Capital’s Head of Sustainability, Asset and Fund managers actively engage with our key stakeholders with the goal of improving sustainability and addressing controversies.

The Fund collects information on the sustainability indicators with the assistance of asset managers, property managers and in cooperation with the tenants. The Fund may use external service providers to gain consumption metering data directly from the utility companies. Taxonomy alignment is assessed in connection to the investment decision making by utilizing Northern Horizon Capital’s EU taxonomy screening tool. Sustainability data is managed and processed in an ESG data and reporting platform. The Fund aims to maintain its high data coverage on consumption data and other ESG characteristics and assure data completeness. However, there may be limitations of data common to the industry the Fund operates due to developing ESG regulations and reporting requirements.

There is no reference benchmark designated for this Fund.

Summaries in other relevant EU member state languages

Full version

No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have as its objective sustainable investment.

Environmental or social characteristics of the financial product

The Fund aims for a carbon-neutral portfolio from operations by 2030, provided that the investment environment allows it. In real estate operations, carbon dioxide emissions derive mainly from energy use, i.e. electricity and heating. Therefore, the Fund commits to strive for 100% fossil-free electricity by 2025 across all real estate assets in the portfolio. The Fund makes also a commitment to non-fossil heating by 2030 across the portfolio.

Investment Strategy

The Fund’s core strategy is to invest in care properties in the four Nordic countries of Denmark, Sweden, Finland, and Norway. Management is executing the investment strategy by acquiring, primarily through acquisition of turn-key development projects, purpose-built care properties leased on long lease contracts to private or public sector residential care providers. The Fund’s primary investment focus is on aged care properties, but, to a limited degree, the Fund can also secure appealing investment opportunities in related sectors, such as (but not limited to) properties in senior housing, clinics, hospitals, or rehabilitation centres. All acquisition targets must naturally comply with the investment criteria of the Fund.

The investment strategy aims for a carbon-neutral portfolio from operations by 2030, provided that the investment environment allows it. In real estate operations, carbon dioxide emissions derive mainly from energy use, i.e. electricity and heating. Therefore, the investment strategy aims at achieving:

- 100% fossil free electricity by 2025 across all real estate assets in the portfolio;

- 100% fossil free heating by 2030 across the portfolio;

- carbon neutral portfolio from operations by 2030;

The Fund acquires real estate assets that are placed in special purpose vehicles for the benefit and purpose of owning these real estate assets. Therefore, the governance practices of these entities are not assessed. However, the management company of the Fund upholds itself to the highest corporate governance practices and all relevant regulations. Good governance principles are also an integral part of the Fund management that also stretches to special purpose vehicles owning the real estate assets.

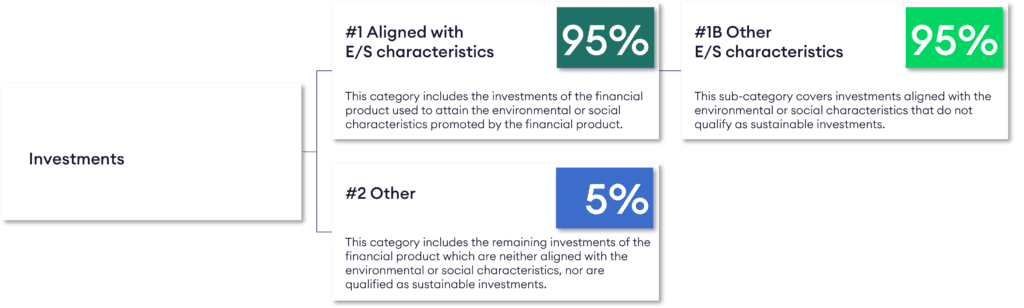

Proportion of investments

To meet the promoted environmental characteristics, the Fund plans to generally invest up to 95% of its total equity commitments into real estate properties. The remaining proportion of investments, amounting up to 5% of the Fund’s assets could be held in a form of cash or cash equivalents to maintain sufficient liquidity.

The Fund does not have in its objective to make sustainable investments within the meaning of Article 9 in SFDR, but it may have a portion of sustainable investments.

Monitoring of environmental or social characteristics

The Fund measures the attainment of the characteristics by the following indicators and metrics:

- percentage of the assets in the portfolio that used fossil-free electricity;

- percentage of the assets in the portfolio that use fossil-free heating;

- operational electricity from renewable or non-fossil sources;

- operational in-use GHG emissions.

Due to changing market environment, development of guidance and interpretation of legislation and other factors, this financial product might add different metrics and indicators other than the indicators and metrics listed above if they will be deemed better at describing the Fund’s attainment of promoted environmental characteristics. Under such a scenario, clear reasoning for such a decision will be provided with a description and calculation methodology of new metrics and indicators.

Northern Horizon Capital AIFM Oy assumes responsibility for the data quality and integrity of the sustainability indicators but may use external sustainability advisors to facilitate data collection and analysis where appropriate. Data on sustainability indicators is gathered directly from the assets and monitored with the assistance of external property managers.

The sustainability indicators are investigated in the due diligence phase for new investments and measured and reported at least annually. Northern Horizon Capital Group has established an ESG Task force that is led by Head of Sustainability and includes Portfolio, Fund and Asset Managers. In accordance with Northern Horizon Capital Group’s Responsible Investment policy, the Task Force gathers at least quarterly to discuss the relevant developments of the ESG factors for the Fund and it may recommend actions to achieve the Fund’s targets. The Fund managers are responsible for implementation of the Responsible Investment policy at Fund level.

Methodologies

In accordance with Northern Horizon Capital Group’s Responsible Investment policy, promoted environmental characteristics are to be considered as part of any due diligence process on a targeted investment and a summary conclusion provided as part of the investment proposal as further instructed by Northern Horizon Capital Group’s Investment Policy.

In addition to monitoring asset level actions, ESG Task Force may recommend and present fund specific actions to attain the fund’s sustainability targets.

Northern Horizon Capital will use its best efforts to include green lease clauses in all new lease agreements and renewals of existing leases. Possible green lease clauses may include agreements of consumption data sharing, preference over renewable energy forms, landlord assistance in relation to refurbishment projects and other matters related to ESG coordination deemed material at time to time.

Data sources and processing

The Fund collects information on the sustainability indicators with the assistance of asset managers, property managers and in cooperation with the tenants. The Fund may use service providers to gain consumption metering data directly from the utility companies. EU taxonomy alignment is assessed in connection to the investment decision making by utilizing Northern Horizon Capital’s EU taxonomy screening tool. Sustainability data is managed and processed in an ESG data and reporting platform.

The Fund aims to assure performance data on energy consumption, waste and water consumption. The Fund limits the use of estimations, and in case they are used, it will be assessed on a case-by-case basis.

Limitations to methodologies and data

There may be limitations to data and methodologies due to developing ESG regulations and reporting requirements that are common to the industry. For instance, the complete data may not be available in case of newly constructed assets. The Fund aims to maintain its high data coverage on consumption data and other ESG characteristics and assure data completeness.

The limitations to methodologies and data do not affect the attainment of the promoted characteristics of the Fund.

Due diligence

Due diligence is conducted in accordance with Northern Horizon Group‘s Responsible Investment policy and Investment policy.

ESG factors are to be considered as part of any due diligence process on a targeted investment and a summary conclusion provided as part of the investment proposal as further instructed by Northern Horizon Capital Group’s Investment Policy. For the purpose of assessing sustainability factors and risks in relation to investments, special purpose questionnaires will be used. This questionnaire will cover relevant sustainability matters including but not limited to:

- Assessment of energy performance – energy supply and access to renewable energy, sources of energy consumption data, energy ratings, building certification, emissions and other relevant topics and as laid down in applicable regulation;

- Assessment of environmental aspects – building materials, contamination, water efficiency, water supply, waste management, EU taxonomy alignment, green lease provisions and other relevant topics;

- Assessment of social aspects – building safety, indoor environmental quality, health and wellbeing, tenant and landlord ESG collaboration, other relevant topics;

- Risks associated with new construction and renovations – site selection, biodiversity, developer selection, their commitment to the Minimum Safeguards, waste management, building materials and other relevant topics;

- Other topics – access to transport links, regulatory risks, review of climate change related transition, physical and social risks, as well as human rights risk and should it be relevant for a specific fund, principal adverse impact indicators.

The Fund may also utilize the assistance of third-party consultants and property managers to conduct ESG due diligence. EU taxonomy screening is conducted in investment decision making in order to comply with the minimum amount of taxonomy aligned investment.

Northern Horizon Capital AIFM uses its best efforts to incorporate ESG impacts (costs and income) into applied financial investment models.

Engagement policies

The Fund does not have a separate engagement policy. Stakeholder engagement is part of Northern Horizon Capital Group’s Responsible investment policy principle 7. Northern Horizon Capital Group’s Head of Sustainability, Asset and Fund managers actively engage with our key stakeholders with the goal of improving sustainability and addressing controversies. Fund manager shall make reasonable efforts to ensure access to all relevant ESG data and stakeholder commitment through surveying, goodwill dialogue, and/or contract negotiations.

No designated reference benchmark

The Fund does not follow a reference benchmark.